Cricket is often spoken of as a game of passion and pride but behind the scenes, it is just as much about money, contracts and balance sheets. Right now, the Pakistan Cricket Board finds itself in a tense situation where one decision could trigger serious financial consequences, potentially reshaping the future of Pakistan cricket.

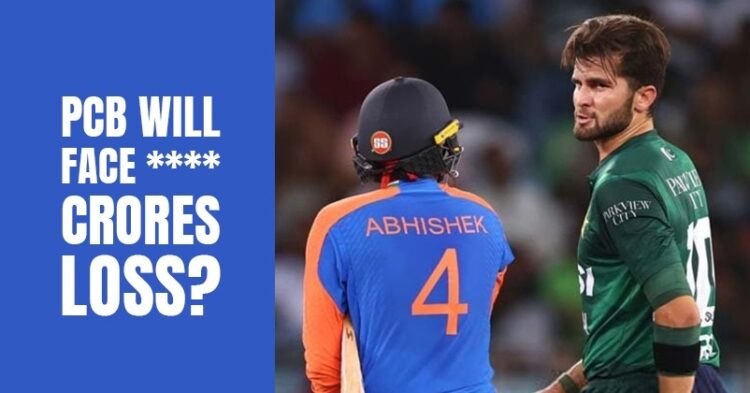

The PCB could be staring at massive losses if the ICC chooses to penalise it for refusing to play Men’s T20 World Cup 2026 match against India, which is scheduled to be held in Colombo on February 15. The concern is not just about one match but about how deeply such a penalty could impact the board’s overall financial health.

According to a PTI report, Pakistan’s share in the ICC’s financial cycle from 2024 to 2027 stands at approximately $144 million. At the highest payout rate, this works out to about $38 million per year going to the PCB. Converted into local currency, this amount is roughly 40 billion Pakistani rupees, a sum that has played a major role in keeping the board financially stable in recent years.

Sources familiar with the situation have indicated that this ICC revenue stream is critical for the PCB. Losing even a portion of it would immediately create financial pressure, affecting everything from operations to long-term planning. The board has already received significant payouts from the ICC for the 2024 T20 World Cup and last year’s Champions Trophy, which Pakistan hosted. In fact, Pakistan earned an additional $6 million from the Champions Trophy, out of a total tournament budget of $70 million.

However, hosting the Champions Trophy also came with heavy expenses. The PCB invested large sums in organising the event, but earnings from ticket sales and hospitality boxes reportedly fell short of expectations. To add to that, Pakistan was able to host only one match at home, as the highly anticipated clash against India was played at a neutral venue in Dubai, following an agreement between BCCI, PCB and ICC.

The board has also spent around 18 billion rupees on upgrading three major stadiums in Lahore, Karachi, and Rawalpindi. This renovation work is still ongoing and has further strained the board’s finances, reducing the net benefit it expected to gain from hosting major tournaments like the Champions Trophy.

Looking ahead, the PCB is yet to receive its shares from the ongoing T20 World Cup and from the 50-over World Cup scheduled for next year. This is where the ICC could impose financial penalties, especially since the PCB is a signatory to the participating teams’ agreement for ICC events. If there is no valid force majeure clause to justify the refusal to play, both the ICC and broadcasters may seek compensation.

Broadcasters, who have paid around $3 billion to the ICC for the current financial cycle, rely heavily on India-Pakistan matches. Each game between the two nations is estimated to generate around $250 million or more. Over four ICC events in this cycle, broadcasters expect to earn roughly $1 billion from four such matches. If these games do not take place, it could lead to a significant drop in overall revenues, which in turn affects the distribution of funds to all member boards, including Pakistan.

Beyond ICC revenues, the PCB also depends heavily on the Pakistan Super League. Starting from the 11th edition this year, franchise fees are expected to bring in around $42 million annually, owing to the addition of two new teams. The Hyderabad and Sialkot franchises were sold for 175 crore rupees and 185 crore rupees respectively, translating to approximately $6.2 million and $6.65 million. After revaluation, five of the six existing franchises will now contribute around $20 million annually in fees.

The PCB is also set to auction the Multan Sultans franchise this month. Based on recent trends, it could fetch around 200 crore rupees or roughly $7 million which is included in the projected annual franchise revenue of $42 million.

At the same time, the board shares most of the PSL’s central pool revenue with franchises. About 95 percent of earnings from media rights, title sponsorships and advertising are distributed, while franchises receive 90 percent of total gate revenues. While this model helps teams, it limits how much the PCB can retain.

Additional income comes from sponsorship deals for the national team and from selling broadcasting rights for home international and domestic matches. Yet, expenses remain high. The PCB spends heavily on subsidising domestic cricket, administrative costs, staff salaries and benefits for around 700 to 800 employees. Player contracts alone reportedly cost between $5 and $6 million annually in monthly retainers.

An audit report by the Auditor General of Pakistan in 2023 also flagged issues such as delays in receiving franchise fees and the absence of bank guarantees in some cases. The report warned of potential losses of 10.751 million rupees from the 7th to the 12th PSL editions, though the sale of two new teams later brought in 360 crore rupees.

Despite all this, the PCB has not published an audited financial report on its website since 2023, a move that stands out against global best practices. With so much riding on ICC revenues and India-Pakistan fixtures, the coming months could prove crucial in determining how financially secure Pakistan cricket truly is.