Non-fungible tokens, commonly known as NFTs, represent a revolutionary development within the blockchain ecosystem. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, NFTs are unique digital assets that are indivisible and irreplaceable, each distinguished by its distinct characteristics and metadata. These tokens are stored on a blockchain, providing proof of ownership and authenticity in a decentralized and transparent manner. The concept of non-fungibility enhances the value of these tokens, making them ideal for representing ownership of digital or physical items.

NFTs have experienced an unprecedented surge in popularity, capturing the attention of creators, collectors, and investors alike. What began as a niche concept has evolved into a global phenomenon, permeating various industries and sparking creative innovation across the digital landscape. The widespread adoption of NFTs has transformed the way we perceive ownership in the digital age. Artists can tokenize, and beyond the initial hype, this investigation seeks to unravel the diverse applications of NFTs, understand their technological underpinnings, and examine their cultural and economic impact.

NFT Essentials: The Unique Characteristics That Set Tokens Apart

Non-fungible tokens (NFTs) are unique digital assets that represent ownership or proof of authenticity for specific items, whether they are digital or physical. Each NFT is distinct and cannot be replaced with any other token, imbuing it with individual value and uniqueness. This non-fungibility sets NFTs apart from traditional cryptocurrencies like Bitcoin or Ethereum, where each unit is interchangeable with another of the same value.

While both NFTs and traditional cryptocurrencies operate on blockchain technology, they serve different purposes and exhibit contrasting features. Traditional cryptocurrencies like Bitcoin buyer are fungible, meaning each unit is interchangeable and holds the same value as any other unit. This interchangeability is essential for use as a medium of exchange, where uniformity ensures equal value across transactions.

NFTs, on the other hand, derive value from their uniqueness. They are not intended for use as a medium of exchange; instead, their primary function is to represent ownership, provenance, and authenticity of specific items. The non-fungible nature of these tokens makes them particularly well-suited for digital art, collectables, virtual real estate, and other applications where distinct ownership is paramount.

Blockchain technology serves as the foundational infrastructure that enables the creation and functionality of NFTs. NFTs are typically built on blockchain platforms that support smart contracts, such as Ethereum. In the context of NFTs, smart contracts define the rules and properties of each token, including its scarcity, ownership, and transferability.

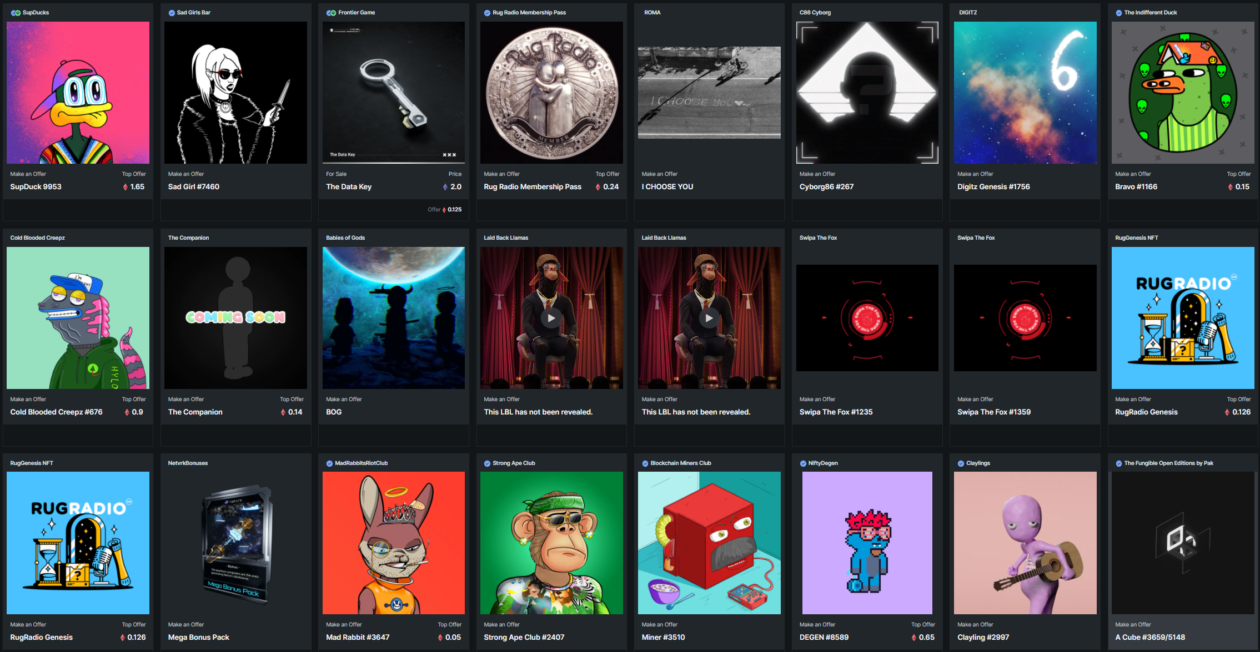

The NFT Marketplaces

Ethereum-Based Platforms (e.g., OpenSea, Rarible):

OpenSea: As one of the largest and most well-known NFT marketplaces, OpenSea operates on the Ethereum blockchain. It facilitates the creation, buying, and selling of a wide range of digital assets, from art and collectables to virtual real estate.

Rarible: Rarible is a decentralized marketplace on Ethereum that allows users to create, sell, and buy NFTs easily. It has gained popularity for its user-friendly interface and openness to various forms of digital content.

Blockchain Ecosystems (e.g., Binance Smart Chain, Flow)

Binance Smart Chain (BSC): BSC has emerged as an alternative blockchain for NFTs, offering faster and more cost-effective transactions compared to Ethereum. Platforms like BakerySwap and Binance NFT Marketplace operate on BSC.

Flow: Flow blockchain has gained attention for its focus on scalability and user experience. NBA Top Shot, a platform for collecting basketball-related NFTs, is built on the Flow blockchain.

NFT marketplaces serve as dynamic hubs, fostering the entire lifecycle of non-fungible tokens (NFTs) by facilitating their creation, buying, and selling. In the realm of creation, these platforms empower creators with essential tools to mint and tokenize their digital assets, transforming them into unique NFTs. This process involves the generation of a distinct token on the blockchain, often accompanied by metadata that intricately details the asset’s specifications. On the buying front, users navigate a vast array of categories on these marketplaces, exploring and purchasing NFTs through processes that may include bidding or direct cryptocurrency transactions. Meanwhile, creators and collectors find a virtual marketplace to showcase and sell their NFTs, where sellers can opt for fixed prices or initiate auctions to ascertain the value of their digital assets.

Despite their pivotal role, NFT marketplaces grapple with challenges such as scalability issues, particularly evident in Ethereum-based platforms, leading to concerns about high gas fees and slower transaction times during peak demand. The increasing volume of NFTs and creators also poses discoverability challenges. However, amid these challenges, marketplaces embrace opportunities, including exploring interoperability across multiple blockchains, paving the way for enhanced user choices and transaction flexibility. Niche marketplaces catering to specific genres, industries, or blockchain ecosystems have the potential to offer unique experiences and tailored services. Moreover, as the NFT space matures, marketplaces have the opportunity to shape regulatory considerations and contribute to the establishment of industry standards, ensuring a more robust and compliant ecosystem.

Sum Up

Our exploration of the NFT ecosystem has uncovered a diverse landscape marked by unique characteristics, innovative use cases, and the pivotal role of marketplaces in NFT creation, buying, and selling. From the definition and distinctive traits of Non-Fungible Tokens (NFTs) to their applications in digital art, gaming, real estate, and intellectual property, it is evident that NFTs have transcended traditional boundaries, transforming how we perceive ownership and value in the digital age. The challenges faced by NFT marketplaces, such as scalability and discoverability issues, underscore the evolving nature of this dynamic ecosystem. However, within these challenges lie opportunities for enhanced interoperability, niche market development, and the establishment of regulatory standards. As the NFT landscape continues to evolve, it becomes clear that its impact extends far beyond the digital realm, leaving an indelible mark on the broader blockchain space. The lasting influence of NFTs lies not only in their current applications but also in the endless possibilities they present for the future, promising continued innovation and adaptation in the ever-changing landscape of decentralized digital ownership.